Click here to access the 2023 Feasibility Study Update

KEY RESULTS AND ASSUMPTIONS;

Key results and assumptions for the updated Feasibility Study are summarized below.

|

|

Units |

2023 FS |

2021 FS |

|

Production Data |

|||

|

Mine Life (operating) |

years |

12.5 |

12.8 |

|

Average Process Plant Throughput |

tpd |

27,700 |

25,200 |

|

Average Process Plant Throughput |

Mt/year |

10.1 |

9.2 |

|

Average Mining Rate |

tpd |

115,000 |

110,000 |

|

Average Mining Rate |

Mt/year |

42 |

40 |

|

Total Ore Mined |

Mt |

127 |

118 |

|

Strip Ratio |

waste:ore |

2.63 |

2.80 |

|

Palladium (payable) |

k oz |

2,122 |

1,905 |

|

Copper (payable) |

M lbs |

517 |

467 |

|

Platinum (payable) |

k oz |

485 |

537 |

|

Gold (payable) |

k oz |

158 |

151 |

|

Silver (payable) |

k oz |

3,156 |

2,823 |

|

LOM Palladium Equivalent Payable |

PdEq. koz |

3,613 |

3,195 |

|

Average Annual Palladium – Payable Metal |

k oz |

166 |

149 |

|

Average Annual Copper – Payable Metal |

M lbs |

41 |

36 |

|

Average Annual Platinum – Payable Metal |

k oz |

38 |

41 |

|

Average Annual Gold – Payable Metal |

k oz |

12 |

12 |

|

Average Annual Silver – Payable Metal |

k oz |

248 |

220 |

|

Operating Costs (Average LOM) |

|||

|

Mining (a) |

$/t mined |

3.25 |

2.53 |

|

Mining |

$/t milled |

11.45 |

9.23 |

|

Processing |

$/t milled |

8.70 |

9.08 |

|

G&Ab |

$/t milled |

2.67 |

2.48 |

|

Transport & Refining Charges |

$/t milled |

4.13 |

2.80 |

|

Royalty |

$/t milled |

0.09 |

0.04 |

|

Total Operating Cost |

$/t milled |

27.04 |

23.63 |

|

LOM Average Operating Costs |

US$/oz PdEq |

709 |

687 |

|

LOM Average AISCc |

US$/oz PdEq |

813 |

809 |

|

Capital Costs |

|||

|

Initial Capital |

$M |

1,112 |

888 |

|

Less: |

|

|

|

|

Pre-commercial production revenue |

$M |

($156) |

($171) |

|

Leased equipment, net of lease payments during construction |

$M |

($58) |

($53) |

|

Initial Capital (Adjusted) |

$M |

898 |

665 |

|

LOM Sustaining Capital |

$M |

424 |

423 |

|

Closure Costs |

$M |

72 |

66 |

|

Financial Evaluation |

|||

|

Pre-Tax Cash Flow (undiscounted) |

$M |

3,387 |

3,004 |

|

Pre-Tax NPV6% |

$M |

1,798 |

1,636 |

|

Pre-Tax IRR |

% |

31.9 |

38.6 |

|

Payback |

years |

2.0 |

1.9 |

|

Net Cash Flow (undiscounted) |

$M |

2,285 |

2,060 |

|

After-Tax NPV6% |

$M |

1,164 |

1,068 |

|

After-Tax IRR |

% |

25.8 |

29.7 |

|

Payback |

years |

2.3 |

2.3 |

|

Key Assumptions (d) |

|||

|

Palladium Price |

US$/oz |

$1,800 |

$1,725 |

|

Copper Price |

US$/lb |

$3.70 |

$3.20 |

|

Platinum Price |

US$/oz |

$1,000 |

$1,000 |

|

Gold Price |

US$/oz |

$1,800 |

$1,400 |

|

Silver Price |

US$/oz |

$22.50 |

$20.00 |

|

Foreign Exchange (“FX”) |

C$:US$ |

1.35 |

1.28 |

|

Diesel Price |

$/litre |

1.17 |

0.77 |

|

Electricity |

$/kWhr |

0.07 |

0.08 |

|

Notes:

|

|||

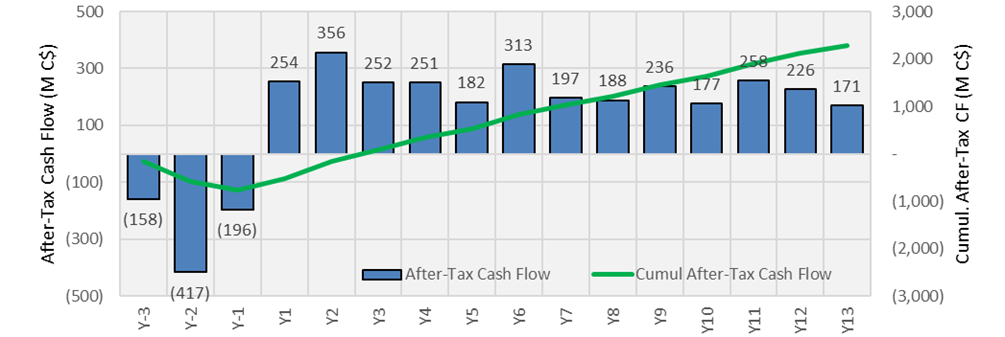

PROJECT CASH FLOW (After Tax)

PRODUCTION

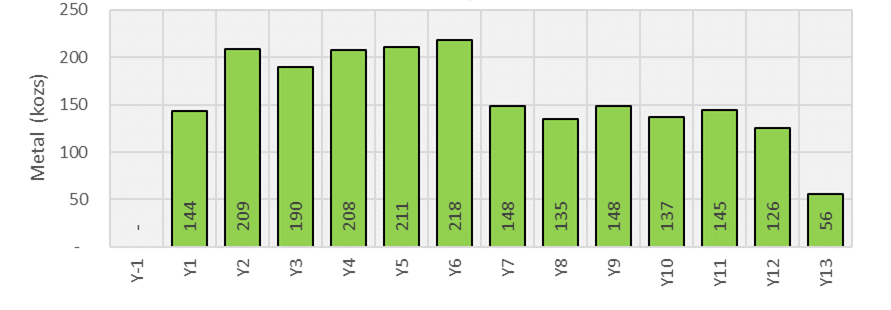

Palladium (Payable metal)

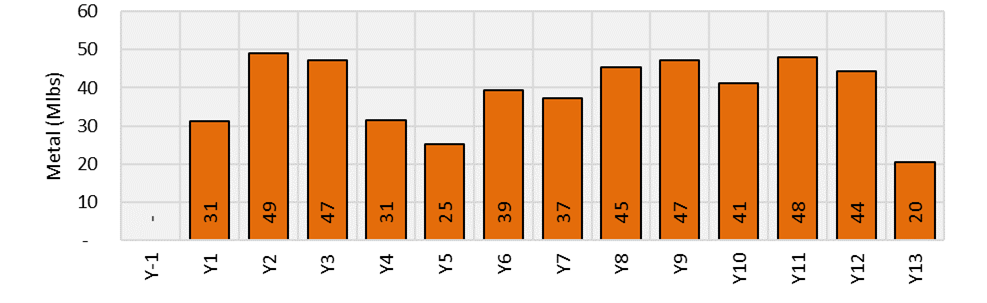

Copper (Payable Metal)

RESOURCES & RESERVES

The Mineral Resource Estimate below is for the combined Marathon, Geordie and Sally deposits. The Mineral Resource Estimates for Geordie and Sally were prepared by P&E Mining Consultants Inc. (“P&E”). The Mineral Resource Estimate for Marathon was prepared by Gen Mining and reviewed by P&E.

Pit Constrained Combined Mineral Resource Estimatea-j for the Marathon, Geordie and Sally Deposits

(Effective date December 31, 2022)

|

Mineral Classification |

Tonnes |

Pd |

Cu |

Pt |

Au |

Ag |

|||||

|

k |

g/t |

koz |

% |

M lbs |

g/t |

koz |

g/t |

koz |

g/t |

koz |

|

|

Marathon Deposit |

|||||||||||

|

Measured |

158,682 |

0.60 |

3,077 |

0.20 |

712 |

0.19 |

995 |

0.07 |

359 |

1.75 |

8,939 |

|

Indicated |

29,905 |

0.43 |

412 |

0.19 |

124 |

0.14 |

136 |

0.06 |

59 |

1.64 |

1,575 |

|

Meas. + Ind. |

188,587 |

0.58 |

3,489 |

0.20 |

836 |

0.19 |

1131 |

0.07 |

418 |

1.73 |

10,514 |

|

Inferred |

1,662 |

0.37 |

20 |

0.16 |

6 |

0.14 |

7 |

0.07 |

4 |

1.25 |

67 |

|

Geordie Deposit |

|||||||||||

|

Indicated |

17,268 |

0.56 |

312 |

0.35 |

133 |

0.04 |

20 |

0.05 |

25 |

2.4 |

1,351 |

|

Inferred |

12,899 |

0.51 |

212 |

0.28 |

80 |

0.03 |

12 |

0.03 |

14 |

2.4 |

982 |

|

Sally Deposit |

|||||||||||

|

Indicated |

24,801 |

0.35 |

278 |

0.17 |

93 |

0.2 |

160 |

0.07 |

56 |

0.7 |

567 |

|

Inferred |

14,019 |

0.28 |

124 |

0.19 |

57 |

0.15 |

70 |

0.05 |

24 |

0.6 |

280 |

|

Total Project |

|||||||||||

|

Measured |

158,682 |

0.60 |

3,077 |

0.20 |

712 |

0.19 |

995 |

0.07 |

359 |

1.75 |

8,939 |

|

Indicated |

71,974 |

0.43 |

1,002 |

0.22 |

350 |

0.14 |

316 |

0.06 |

140 |

1.5 |

3,493 |

|

Meas. + Ind. |

230,656 |

0.55 |

4,079 |

0.21 |

1,062 |

0.18 |

1,311 |

0.07 |

499 |

1.67 |

12,432 |

|

Inferred |

28,580 |

0.39 |

356 |

0.23 |

143 |

0.1 |

89 |

0.04 |

42 |

1.45 |

1,329 |

|

Notes:

|

|||||||||||

The Mineral Reserve estimate for the Project includes only the Marathon Deposit. The Mineral Reserve Estimate was prepared by G Mining Services Inc.

Marathon Project Open Pit Mineral Reserve Estimatesa-i

(Effective Date of December 31, 2022)

|

Mineral Reserves |

Tonnes |

Pd |

Cu |

Pt |

Au |

Ag |

|||||

|

kt |

g/t |

koz |

% |

M lb |

g/t |

koz |

g/t |

koz |

g/t |

koz |

|

|

Proven |

114,798 |

0.65 |

2,382 |

0.21 |

530 |

0.20 |

744 |

0.07 |

259 |

1.68 |

6,191 |

|

Probable |

12,863 |

0.47 |

193 |

0.20 |

55 |

0.15 |

61 |

0.06 |

26 |

1.53 |

635 |

|

P & P |

127,662 |

0.63 |

2,575 |

0.21 |

586 |

0.20 |

806 |

0.07 |

285 |

1.66 |

6,825 |

Note:

- Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions) were used for Mineral Reserve classification.

- Mineral Reserve Estimate completed by Alexandre Dorval, P.Eng., of GMS, an independent QP, as defined by NI 43-101.

- Mineral Reserves were estimated at a cut-off value $16.90 NSR/t of ore.

- Mineral Reserves were estimated using the following long-term metal prices: Pd = US$1,500/oz, Pt = US$1,000/oz, Cu = US$3.50/lb, Au = US$1,600/oz and Ag = US$20/oz, and an exchange rate of 1.30C$ to 1 US$. The pit designs are based on a pit shell selected at a revenue factor of 0.74.

- A minimum mining width of 5 m was used.

- Bulk density of ore is variable and averages 3.1 t/m3.

- The average strip ratio is 2.6:1.

- The average mining dilution factor is 9%.

- Numbers may not add due to rounding.